Blog

We keep you up-to-date on the latest tax changes and news in the industry.

Don’t Overlook Business Beneficial Ownership Reporting

Article Highlights

Corporate Transparency Act (CTA)

Financial Crimes Enforcement Network (FinCEN)

Companies Required to Report Beneficial Ownership Information

Exemptions From Reporting Requirement

Who is a Beneficial Owner

Who Is a Company Applicant of a Reporting Company?

Definition of Substantial Control

Filing Due Dates

Penalties

Updates

Small Entity Compliance Guide

How Does a Company File a BOI Report

In the ever-evolving landscape of business regulations, the Corporate Transparency Act (CTA), passed as part of the National Defense Authorization Act for Fiscal Year 2021, introduces new reporting requirements for businesses in the United States, specifically focusing on beneficial ownership. This reporting starts in 2024, and it is something you need to be aware of and take action on if yours is a reporting company.

The CTA aims to combat illicit activities such as money laundering, tax fraud, and terrorism financing by increasing transparency in the ownership structures of companies. It requires corporations, limited liability companies (LLCs), and similar entities to report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

What Is FinCEN? - The Financial Crimes Enforcement Network (FinCEN) is a bureau of the U.S. Department of the Treasury. Established in 1990, FinCEN's primary role is to safeguard the financial system from illicit use, combat money laundering, and promote national security through the collection, analysis, and dissemination of financial intelligence.

FinCEN works closely with law enforcement agencies, intelligence agencies, financial institutions, and regulatory entities. It implements and enforces compliance with certain parts of the Bank Secrecy Act, including the requirement for financial institutions to report suspicious activities that might signify money laundering, tax evasion, or other financial crimes.

FinCEN also plays a crucial role in fighting terrorism by tracking and cutting off sources of funding for terrorist activities. It achieves this by analyzing financial transactions and sharing this information with domestic and international partners.

Companies Required to Report Beneficial Ownership Information (BOI) to FinCEN - There are two types of reporting companies:

Domestic reporting companies - corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States. This includes single member LLCs.

Foreign reporting companies - entities (including corporations and limited liability companies) formed under the law of a foreign country that have registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

Exemptions From Reporting Requirement - The Corporate Transparency Act exempts 23 types of entities from the beneficial ownership information reporting requirement. Carefully review the qualifying criteria of the exemptions before concluding that your company is exempt. For more detail see BOI_Small_Compliance_Guide.v1.1-FINAL.pdf (fincen.gov)

Certain types of securities reporting issuers.

A U.S. governmental authority.

Certain types of banks.

Federal or state credit unions as defined in section 101 of the Federal Credit Union Act.

Bank holding company as defined in section 2 of the Bank Holding Company Act of 1956, or any savings and loan holding company as defined in section 10(a) of the Homeowners’ Loan Act.

Certain types of money transmitting or money services businesses.

Any broker or dealer, as defined in section 3 of the Securities Exchange Act of 1934, that is registered under section 15 of that Act (15 U.S.C. 78o).

Securities exchanges or clearing agencies as defined in section 3 of the Securities Exchange Act of 1934, and that is registered under sections 6 or 17A of that Act.

Certain other types of entities registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934.

Certain types of investment companies as defined in section 3 of the Investment Company Act of 1940, or investment advisers as defined in section 202 of the Investment Advisers Act of 1940.

Certain types of venture capital fund advisers.

Insurance companies defined in section 2 of the Investment Company Act of 1940.

State-licensed insurance producers with an operating presence at a physical office within the United States, and authorized by a State, and subject to supervision by a state’s insurance commissioner or a similar official or agency.

Commodity Exchange Act registered entities.

Any public accounting firm registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002.

Certain types of regulated public utilities.

Any financial market utility designated by the Financial Stability Oversight Council under section 804 of the Payment, Clearing, and Settlement Supervision Act of 2010.

Certain pooled investment vehicles.

Certain types of tax-exempt entities.

Entities assisting a tax-exempt entity described in (14) above.

Large operating companies with at least 20 full-time employees, more than $5,000,000 in gross receipts or sales, and an operating presence at a physical office within the United States.

The subsidiaries of certain exempt entities.

Certain types of inactive entities that were in existence on or before January 1, 2020, the date the Corporate Transparency Act was enacted.

Many of these exempt entities are already regulated by federal and/or state government, and many already disclose their beneficial ownership information to a governmental authority.

Who is a Beneficial Owner – A beneficial owner, as defined by the CTA, is an individual who exercises substantial control (see definition below) over a company or owns or controls at least 25% of the ownership interests of that company. There can be multiple beneficial owners for a single company. The CTA excludes certain entities from this requirement, such as publicly traded companies, banks, credit unions, and certain regulated entities, among others.

The information to be reported includes each beneficial owner's full legal name, date of birth, current residential or business street address, and a unique identifying number from an acceptable identification document, such as a passport or driver’s license. This information must be updated within 30 days of any change in beneficial ownership.

Non-compliance with the CTA can result in hefty fines and potential imprisonment. Therefore, it is crucial for businesses to understand their obligations under this new law and take the necessary steps to comply.

The CTA represents a significant shift in U.S. corporate law, and its impact will be far-reaching. While it aims to enhance corporate transparency and combat illicit activities, it also imposes new administrative burdens on small and medium-sized businesses.

Companies will need to devote resources to identify their beneficial owners, collect the required information, and report it to FinCEN. They will also need to ensure that this information is kept up to date, which could require ongoing monitoring and reporting efforts.

Moreover, the CTA raises privacy concerns. Although FinCEN is required to keep the reported information confidential, it can be disclosed in certain circumstances, such as in response to a request from law enforcement agencies.

Who Is a Company Applicant of a Reporting Company?

Per FinCEN Q&A Section E- There can be up to two individuals who qualify as company applicants:

The individual who directly files the document that creates, or first registers, the reporting company; and

The individual that is primarily responsible for directing or controlling the filing of the relevant document.

No reporting company will have more than two company applicants. If only one person was involved in filing the relevant document, then only that person should be reported as a company applicant.

When must a company applicant be reported:

Only reporting companies formed or registered on or after January 1, 2024, will have to report their company applicants.

Companies created or registered before January 1, 2024, do not have to report their company applicants.

The following examples illustrate how to identify company applicants in common company creation or registration scenarios.

Example 1: Individual A is creating a new company. Individual A prepares the necessary documents to create the company and files them with the relevant state or Tribal office, either in person or using a self-service online portal. No one else is involved in preparing, directing, or making the filing.

Individual A is a company applicant because Individual A directly filed the document that created the company. Because Individual A is the only person involved in the filing, Individual A is the only company applicant. State or Tribal employees who receive and process the company creation or formation documents should not be reported as company applicants.

Example 2: Individual A is creating a company. Individual A prepares the necessary documents to create the company and directs Individual B to file the documents with the relevant state or Tribal office. Individual B then directly files the documents that create the company.

Individuals A and B are both company applicants—Individual B directly filed the documents, and Individual A was primarily responsible for directing or controlling the filing. Individual B could, for example, be Individual A’s spouse, business partner, attorney, or accountant; in all cases, Individuals A and B are both company applicants in this scenario.

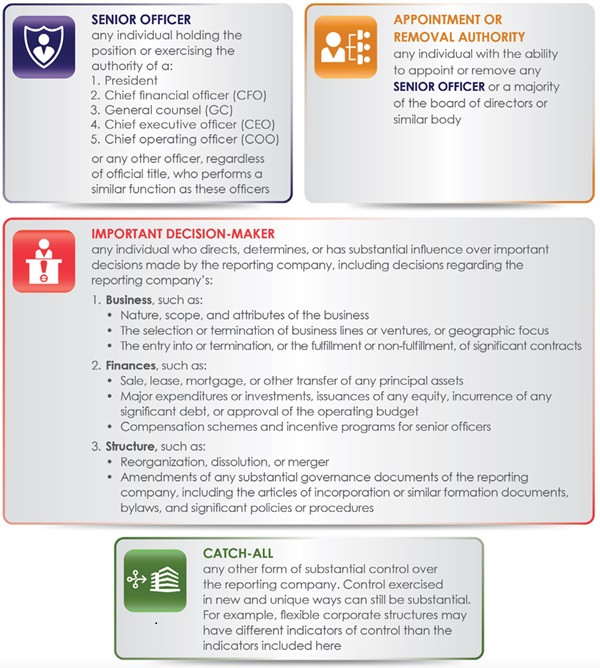

Definition of Substantial Control - Substantial Control is best described by graphics taken from FinCEN instructions.

Filing Due Dates

Existing Businesses - If your company already exists as of January 1, 2024, it must file its initial BOI report by January 1, 2025, which provides plenty of time to comply. But it is best not to procrastinate and risk penalties for not complying.

New Businesses - For a U.S. business newly created on or after January 1, 2024 and before January 1, 2025, as well as a foreign entity that becomes a foreign reporting company in that time frame, the BOI report is due 90 calendar days from the earlier of the date on which the business receives actual notice that its creation has become effective or the date on which a secretary of state or similar office first provides public notice that the company has been created or registered. The reporting deadline is reduced to 30 days for both U.S. and foreign entities created or registered on or after January 1, 2025.

In addition to information about the company and beneficial owners, these businesses must also report information about the “company applicant,” as defined above

Penalties - If a person has reason to believe that a report filed with FinCEN contains inaccurate information and voluntarily submits a report correcting the information within 90 days of the deadline for the original report, then the CTA creates a safe harbor from penalty. However, should a person willfully fail to report complete or updated beneficial ownership information to FinCEN as required under the Reporting Rule, FinCEN will determine the appropriate enforcement response in consideration of its published enforcement factors. The willful failure to report complete or updated beneficial ownership information to FinCEN, or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in civil penalties of up to $500 (inflation adjusted to $591, effective January 25, 2024) for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure. So, this reporting requirement should not be taken lightly.

Updates - When the information an individual or reporting company reported to FinCEN changes, or when the individual or reporting company discovers that reported information is inaccurate, the individual or reporting company must update or correct the reported information, as applicable, within 30 days. For example, if the individual submitted a copy of their driver’s license to FinCEN when the initial report was filed, when the license expires and a new one is issued, the previously filed report must be updated within 30 days.

FinCEN Small Entity Compliance Guide - This 50-page guide includes interactive flowcharts, checklists, and other aids to help determine whether a company needs to file a BOI report with FinCEN, and if so, how to comply with the reporting requirements. This Guide will be updated periodically with new or revised information. FinCEN also provides frequently asked questions and answers.

How Does a Company File a BOI Report? If your company is required to file a BOI report, you must do so electronically through FinCEN’s online secure filing system. FinCEN began accepting BOI reports January 1, 2024.

FinCEN provides instructions and other technical guidance on how to complete the BOI report form.

Navigating the complexities of the CTA and its reporting requirements can be challenging. If you need assistance, contact this office for a consultation and to help you find your way through this new regulatory landscape.